Background

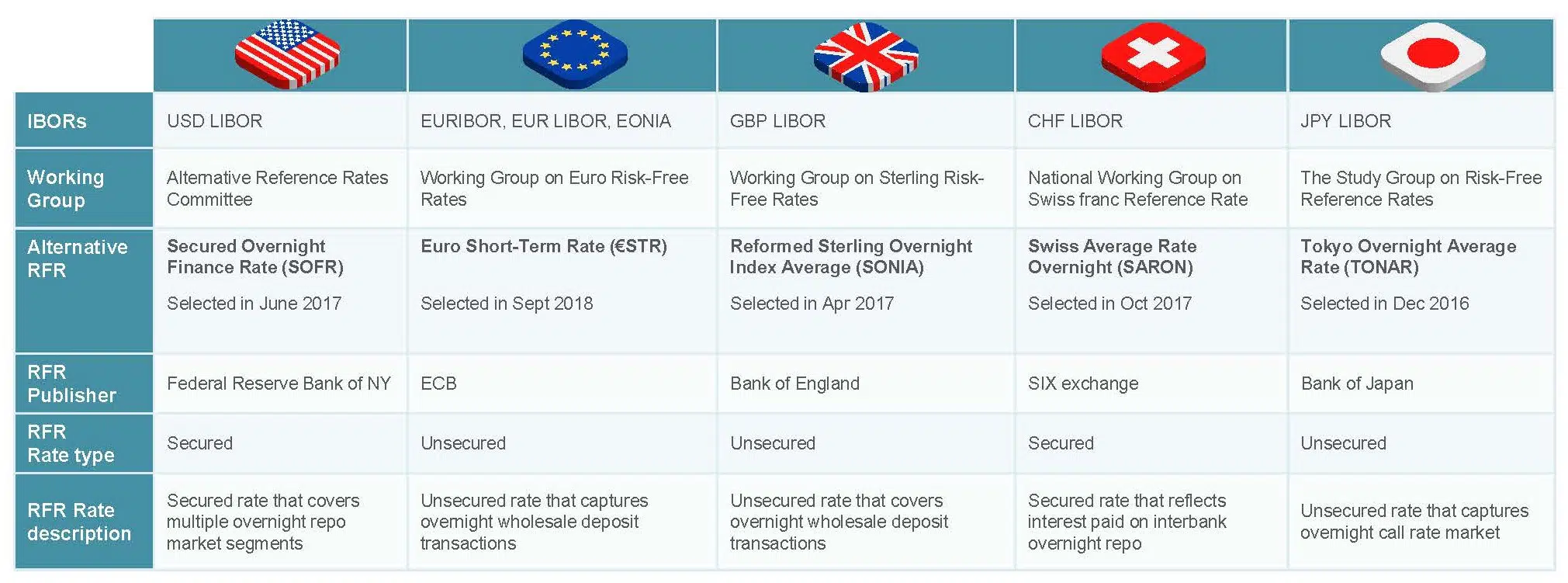

Following the Libor scandal exposed in 2012, the G20 governments asked the Financial Stability Board to review the use of benchmark rates in the financial industry. As a result, in recent years, a global benchmark reform process has been creating a shift from the old interbank offered rates (“IBORs”) towards novel, robust, and transparent overnight risk-free rates (“RFRs”).

This leads us to the discontinuation of several historically important benchmarks that have dominated the landscape of mortgages, securitization, derivatives, and other complex financial transactions for decades.

In Europe, the European Benchmark Regulation(1) (‘BMR’) has been the catalyst for major transition from the old regime of benchmarks towards new and alternative reference rates set to transform the finance industry.

BMR includes two main contract related obligations:

- A “Prohibition on use of a non-compliance benchmark” obligation under Article 29(1) of BMR. Supervised entities are prohibited from using a benchmark (or a combination of benchmarks) in the European Union unless the benchmark complies with BMR and is provided by a register administrator(2); and

- A “Fallback” obligation: in accordance with the article 28(2) “Changes to and cessation of a benchmark”. “Supervised entities (…) that use a benchmark shall produce and maintain robust written plans setting out the actions that they would take in the event that a benchmark materially changes or ceases to be provided. Where feasible and appropriate, such plans shall nominate one or several alternative benchmarks that could be referenced to substitute the benchmarks no longer provided, indicating why such benchmarks would be suitable alternatives.”

The purpose of such “Fallback” is to define the steps that will be taken to identify and agree an alternative benchmark if the original benchmark ceases to be available or materially changes and what happens if an alternative cannot be agreed.

The impact of BMR is not a simple limitation in contract drafting, rather, it regulates the model itself (governance, methodology, etc.). Consequently, some of the major European financial benchmarks will cease to be published.

Cession Timescale

On 5 March 2021, the UK Financial Conduct Authority confirmed that as from the end of 2021, the London Inter-bank Offered Rates (LIBOR) for tenors in all currencies (EUR, GBP, CHF, USD(3) and JPY) will either cease to be published or cease to be representative of the market it is intended to measure.

Similarly, the Euro Overnight Index Average (EONIA) – the 1-day interbank interest rate for the Euro zone – defined by the European Money Markets Institute – will cease to be published after 3 January 2022. The definition and calculation methodology for EONIA, in its previous form, does not comply with BMR.

LIBOR and EONIA will need to be replaced by recommended alternative RFRs.

European Central Bank, Working Group on €uro Risk-Free Rates, www.ecb.europa.eu

Financial Variance Due to Change

The transition to alternative RFRs will affect all entities (financial or not) who use financial services that rely on LIBORs or EONIA as a reference rate (transaction underlying, interest, or default rate, etc.).

The new models can have a direct effect on the financial outcomes for contracting parties as it may affect the economic balance (or event viability) of a financial product which uses a benchmark that does not comply with BMR This occurs in three ways:-

- If a benchmark’s methodology is changed to comply with regulation, then it may perform differently;

- If a benchmark ceases to exist (or to be published) and needs to be replaced by an alternative fallback discretionary designated by a third party or by the other party;

- If a benchmark ceases to exist or to be published without contractual fallback, the applicable law(4), arbitration decisions or judgement will apply to this lack of provision. There is a risk that such fallback terms do not adequately cater for the economic circumstances in which they need to be used.

Despite the deadlines for major European financial benchmarks, many firms are not ready for or fully aware of the scale of contractual workload required by this transition, especially in respect of Over The Counter (OTC) derivative market.

Derivatives Documentation

Having established that there is a significant amount of change about to occur which has the potential for financial impact, we must turn to how risk can be mitigated.

Over The Counter (‘OTC’) derivatives transactions are, as a matter of standard practice, documented under master agreements entered into for trading relationships. The master agreements most frequently used in the market are those published by the International Swaps and Derivatives Association, Inc. (ISDA).

However, some institutions may also utilise:-

- Gas or Power European Federation of Energy Traders (EFET) master agreements;

- Cross-product master agreements (Master Netting Agreement, EFET Cross-Product Master Agreement, European Master Agreement); or

- National master agreements (French FBF, German Rahmenvertrag, Spanish CMOF, Swiss Master Agreement, etc).

Master agreements under which OTC transactions are collateralized normally include a specific “Credit Support Annex” (CSA). CSA remediation is where much of the work lies prior to the upcoming change deadlines.

CSAs

Unlike for other aspects of ISDA documentation, there has not been a standardised approach taken in relation to interest rates used for cash collateral.

However even if there is currently no related protocol for multilaterally amending collateral rates, ISDA has published some useful resources in this regard. There are a number of shortcuts which can help streamline the re-papering process:

- Rate Definitions

Given the BMR requirement (inclusion of robust contractual fallbacks) as well as the expectation that the rates currently used (primarily EUR (EONIA) and USD (US LIBOR)) will need to be amended to refer to €STR and SOFR , ISDA published the “2020 Collateral Agreement Interest Rate Definitions”.

The current version contains definitions for the RFRs in nine currencies, namely AONIA for AUD, CORRA for CAD, SARON for CHF, both EONIA and €STR for EUR, SONIA for GBP, HONIA for HKD, TONA for JPY, SORA for SGD and SOFR for USD.

Except for EONIA(5) (and SORA), the triggers and fallbacks for the RFRs are intended, as far as possible, to follow the same approach taken for fallbacks to the RFRs that will be adopted in the ISDA IBOR Fallbacks Supplement.

By incorporating the Collateral Agreement Interest Rate Definitions into a CSA, parties can use the same standardised definitions relating to overnight interest rates with a robust fallback that apply if the relevant collateral rate is permanently discontinued or temporarily fails to be published. In other words, this represents a short cut when drafting.

- Application to Multiple Documents

ISDA has also proposed a bilateral amendment template to enable counterparties to amend references to benchmark across multiple document types and to incorporate the Collateral Agreement Interest Rate Definitions in the CSA. In this way the amount of repapering work can be streamlined.

- Rate Switch Template

ISDA have produced a specific amendment agreement template to address the switch from EONIA to €STR, not just in CSAs but also for trade cash-flows which currently reference EONIA.

This amendment specifically proposes an option to include the 8.5 basis points spread existing between EONIA and €STR and an option for compensation of a counterparty for agreeing to the switch. If the other party refuses to pay such compensation all reference to EONIA will replaced by “Modified €STR” (aka the level of €STR plus 0.085%) instead of €STR “flat”.

It is also worth noting that in Europe, USD CSA’s may continue to reference Fed-Funds for the accrual of interest on the USD collateral posted. Given there is no suggestion that Fed-Funds will be discontinued (unlike EONIA), the only pressing amendment required for this tranche of documentation is the inclusion of a Fallback.

Transactions

ISDA has also made changes in relation to transactions in order to reduce the amount of documentation required at the deadlines.

To comply with the Benchmark Regulation, ISDA supplemented its benchmark related definitions in relation to SONIA, €STR and EONIA(6). Any new derivatives transactions documented in a confirmation referring to the 2006 ISDA Definitions will automatically include these Supplements.

ISDA published a Benchmarks Supplement, in relation to the 2006 ISDA Definitions, the 2002 ISDA Equity Derivatives Definitions, the 1998 FX and Currency Option Definitions and the 2005 ISDA Commodity Definitions, which includes:

- fallbacks which apply if a benchmark ceases to be provided or if a benchmark or its administrator is not approve or include in an official register (including where such approval or inclusion is suspended or withdrawn) and

- acknowledgements regarding the consequences following a change to a benchmark.

- In contrast to generally applicable supplements to ISDA Definitions (such as numbered supplements to the 2006 ISDA Definitions mentioned above), parties need to expressly incorporate this Benchmarks Supplement by including a statement in the document indicating that the document incorporates the relevant ISDA Definitions Booklet and this Benchmarks Supplement.

In respect of legacy transactions, ISDA has proposed an “ISDA 2018 Benchmarks Supplement Protocol”.

The 2018 Benchmarks Supplement Protocol allows parties to OTC derivative transaction referring to the relevant ISDA definition to incorporate the ISDA Benchmarks Supplement into relevant transactions. When an entity adheres to the protocol, it decides if the Benchmark Supplement covered all transactions (« Legacy Protocol Covered Confirmations ») or only the new one (« New Protocol Covered Confirmations »).

In respect of fallback provisions, ISDA published Supplement 70 which amends the 2006 ISDA Definitions in order to includes specific fallbacks to the IBORs. For some, this includes a “Fallback Rate” based on the recommended alternative Risk Free Rate (plus or minus a spread) and designated usually designed as “Fallback rate (name of the recommended RFR)”(7).

In respect of legacy transactions before 25 January 2021, ISDA proposed an “ISDA 2020 IBOR Protocol”.

Similar to the 2018 Benchmarks Supplement Protocol, the IBOR Protocol adherence permits to amend all (but not less than all) of its legacy IBOR-denominated transactions (which may also include transactions that do not use ISDA documentation or additional non ISDA Agreement like FBF Master Agreement or CMOF).

ISDA has also published a series of “bilateral” templates that cater to market participants who wish to conform the Protocol amendments with only one or a limited set of counterparties, who wish to narrow or expand the universe of covered documents, or who wish to tailor the Protocol amendments in various other ways.

It is worth noting that despite any potential “replacement fallbacks”, the parties to a contract may agree bilaterally to apply a different replacement for a benchmark to the one designated by the European Commission or the national competent authority. In other words, there is still the potential for bespoke arrangements in relation to particular counterparties.

Conclusion

ISDA has published a number of legal tools in order to facilitate transition and reduce the re-papering burden on financial institutions.

BMR includes the possibility that the EU regulator may designate a “replacement benchmark” but it is important to note that the main tool used by the parties to OTC Transactions will still be the bilateral amendment.

Due to the nature of these amendments, planning and flexibility will be needed given the scale of re-papering required for transition and the likelihood of diverging approaches across different institutions.

NOTES

- Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds, as amended by Regulation (EU) 2019/2089 of the European Parliament and of the Council of 27 November 2019 and Regulation (EU) 2021/168 of the European Parliament and of the Council of 10 February 2021

- N.B. Supervised Entity may also use the replacement for a benchmark designated in accordance with Article 23 b (“Replacement of a benchmark by Union law”) or Article 23 c (“Replacement of a benchmark by national law”) of BMR.

- Other than USD LIBOR for overnight, one-month, three-month, six-month, and twelve-month tenors – USD LIBOR for those tenors will continue to be published until 30 June 2023 to reduce the amount of legacy USD LIBOR deals needing to transition.

- Including a replacement benchmark designated in accordance with Article 23 b (“Replacement of a benchmark by Union law”) or Article 23 c (“Replacement of a benchmark by national law”) of BMR

- The ISDA IBOR fallbacks documents only contemplate using €STR (rather than EONIA) as a fallback rate.

- Especially, supplement 55 (published 23 April 2018), amending the SONIA benchmark related definition, supplement 59 (published 1st October 2019), adding a new Section 7.1(f)(lvi) related to €STR and supplement 60 (published 1st October 2019), amending the existing EONIA Floating Rate Options in the 2006 ISDA Definitions to embed fallbacks in the event of a permanent cessation of EONIA (and so the future use of €STR after the EONIA Cessation Event).

- For example, after their cessation, all reference to GBP Libor will be replaced by “Fallback rate (SONIA)” (aka SONIA + spread); CHF Libor by Fallback rate (SARON); USD Libor by Fallback rate (SOFR); Euro Libor by Fallback rate (€STR) and Euribor – covered even if it is currently BMR compliance – Fallback rate (€STR).